The Best Crypto IRAs

For investors with long-term goals and a desire to put a few chips on a blockchain based future, crypto IRAs have become the latest retirement planning trend.

An IRA can help you save or even completely avoid capital gains tax. This is fantastic for a high growth asset like crypto. With the overall perception and adoption of crypto continuing to grow, more and more people are trading in part of their traditional IRAs for crypto IRAs. That said, before you do the same, it’s important to understand crypto IRAs and how they work.

In this article, you’ll dive deep into crypto IRAs and learn all about what they are, what they do, their risks and benefits, and more. You’ll also learn about three of the best crypto IRAs out there today, the pros and cons of each, and how they can help you reach your retirement goals.

For those of you wanting a quick answer:

The short answer is that iTrustCapital has our vote for “best crypto ira” for a few reasons

iTrustCapital is incredibly popular and has done over $6 Billion in transaction volume. It has a low 1% trading fee (and no other fees). iTrustCapital is starting to enable staking with Proof of Stake coins within your IRA.

Or for those of you want to learn a lot more, including a second option that is a very close runner up, read on…

What are IRAs?

Short for Individual Retirement Accounts, IRAs are more popular than any other type of retirement account. With an IRA, you can invest your retirement dollars in stocks, bonds, and several other financial instruments for tax-free growth.

That’s right; IRAs allow you to earn tax-deferred income or growth, potentially saving you $100k+ by the age of 59.5, which is when you can withdraw IRA funds without incurring a penalty.

This is the catch with IRAs – you can only withdraw money from them without hefty penalties after you reach 59.5 years of age. Along with tax-deferment incentives, this age restriction is the U.S. government’s way of encouraging citizens to save for retirement, rely less on social security, and keep driving the economy in their older years.

When choosing an IRA, you’ll find there are two primary types to choose from: traditional IRAs and Roth IRAs. You can go with either option when you open and fund a crypto IRA account, but before we dig into the crypto side of IRAs, let’s first go over these two popular IRA structures.

Traditional IRAs

Traditional IRAs are retirement savings accounts funded with pre-tax dollars. Therefore, any contributions you make into one of these accounts are deducted from your annual taxable income.

After age 59.5, however, withdrawals are taxed as current income. This makes traditional IRAs a solid option if you expect to be in a lower tax bracket than your current one later in life.

Roth IRAs

Roth IRAs are a bit different. Unlike traditional IRAs, Roth IRAs are funded with after-tax dollars. This means you won’t receive a tax deduction for money you put into the account.

On the bright side, with Roth IRAs, your money grows tax-free. You can also withdraw money tax-free after the 59.5-year age threshold. This is great for avoiding hefty capital gains taxes. It’s also great if you plan on being in a higher tax bracket later in life as withdrawals are not counted towards annual income after reaching age 59.5.

Nonetheless, there’s no universal truth as to whether one type of IRA is better than the other. It depends on you and your circumstances.

Overall, you can’t go wrong with saving for retirement, regardless of which type of IRA you choose. It really depends on your individual income situation each year. Some people have both traditional and Roth IRAs, and they make contributions according to their income that year.

Crypto IRAs allow you to choose either structure. However, if you go with Crypto IRA, and you are bullish on crypto’s long-term growth prospects, a Roth IRA may make the most sense in order to avoid taxes on capital gains.

Continuing with this example, if you contribute $10k into aCrypto IRA to purchase Bitcoin and the price of BTC balloons 100x by the time you reach retirement age, your 990k gain is all yours to keep “tax free.”

With our bases covered, let’s further explore crypto IRAs and see what they’re all about.

What are Crypto IRAs?

Crypto IRAs are a form of self-directed IRAs in which you can invest and store crypto within an IRA. With a crypto IRA, you can experience the potential explosive gains provided by the volatile crypto space while enjoying the same tax benefits as other types of IRAs and asset classes.

Crypto IRAs follow the same tax protocols as conventional IRAs. The only difference is the use of a crypto exchange and digital wallet to purchase and store your crypto rather than using a stock broker to execute trades of stocks, bonds, and other conventional asset classes.

So, in a nutshell, crypto IRAs offer the best of both worlds: extreme potential growth and savings. However, whether or not the crypto you invest in rises or falls over time is anyone’s guess. That’s the nature of the game, but investing in the right crypto and the best crypto IRA will certainly help.

Pros and Cons of Crypto IRAs

Like everything else, crypto IRAs aren’t perfect or ideal for everyone. To help decide if a crypto IRA is right for you, it’s important to consider the pros and cons of these forward-thinking, tax-friendly investment vehicles.

Crypto IRA Pros

Product Cons

Crypto IRA Risks & Rewards

Despite the risks of crypto markets, crypto IRAs are continuing to grow in popularity. Long term crypto investments still offer the chance at a home run. Taking that chance inside a tax advantageous IRA can pay off big.

Crypto IRAs are still relatively new to the scene. That means you can get ahead of the pack by using crypto to fuel your retirement dreams (and tax savings). The top companies for doing that are: iTrustCapitaltal IRA, Alto Crypto IRA, and Bitcoin IRA.

Best Crypto IRAs

As crypto continues to evolve and become increasingly mainstream, crypto IRAs are increasing in popularity each and every day. With this increase in popularity comes an increase in demand. While there are now several options available for crypto enthusiasts interested in long-term tax-free savings, three crypto IRAs continue to stand out as the best of the best.

iTrustCapital

Recently surpassing $6 billion in transactions and over 175,000 accounts, the iTrustCapital IRA is hands down one of the largest and most respected crypto IRAs currently on the market.

With an intuitive self-directed trading experience and low fees, it’s also one of the best crypto IRAs in terms of user experience. Whether you’re a seasoned investor or looking for your first opportunity, you’ll find the platform simple and straightforward, allowing you to hit the ground running.

The best part of iTrustCapital, however, is its staking capabilities. Unlike other crypto IRAs, iTrustCapital offers the ability to stake crypto and earn while holding your IRA investments. This feature is still in beta and only available for some assets, but more are rolling out each day.

For even greater flexibility, the platform gives you the option of choosing your disbursement in cash or crypto assets whenever you’re ready to retire and withdraw money out of your iTrustCapital IRA.

Coin Offerings

If your idea of the best crypto IRA is one with hundreds of coins to invest in, like the Alto Crypto IRA, iTrustCapital may disappoint you. Admittedly, it’s weak in this department and offers just under 30 different cryptocurrencies to invest in.

That said, it supports all of the major players in the crypto world. So most of the coins you would probably want to buy are readily available on the platform. Not financial advice, but investing in small cap cryptos with your IRA might not be the safest move anyway.

Through iTrustCapital you can also invest in gold and silver to further diversify your IRA holdings and portfolio. All precious metals available on the platform are physically held in custody at the Royal Canadian Mint.

Crypto Staking With IRA

iTrustCapital now allows you to stake some of the major Proof of Stake coins inside of your IRA account. Since IRAs are made for long term investing, staking crypto, so that it grows overtime is an EXCELLENT addition to boost your returns.

Staking crypto with iTrustCapital is a new feature so it is being rolled out slowly, coin by coin. You can expect almost all the major coins to be added eventually, and check out which coins are available through staking via their website.

Minimum Investment

The minimum investment needed to open an iTrustCapital IRA is $1,000. This minimum is regardless of whether you opt for a traditional or crypto Roth IRA.

Fees

Similar to the Alto Crypto IRA, the iTrustCapital IRA charges a flat one percent fee on crypto trades rather than a monthly fee. There’s also a one-time fee of $75 for converting a traditional or Roth IRA into a crypto IRA.

Safety and Security

Like the other crypto IRAs on this list, iTrustCapital is pretty safe as Coinbase acts as its custodian and keeps most of your crypto in cold storage. Of course, you also get the same insurance protections against cybercrime, hacks, and theft. The use of Fireblocks provides an added layer of security as well.

Product Pros

Product Cons

Alto Crypto IRA

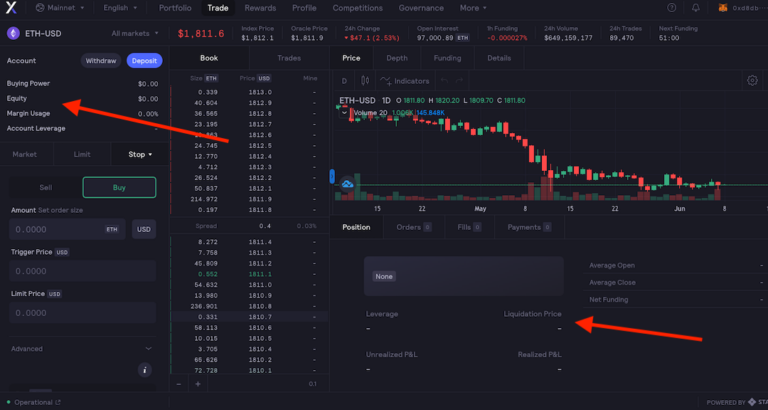

The Alto Crypto IRA directly integrates with coinbase. This makes the Alto Crypto IRA a very close second to iTrustCapital.

Alto IRA offers both traditional and Roth IRAs available in its two primary investment products – the Alto Crypto IRA and the Alto Alternative IRA.

As its name suggests, the Alto Alternative IRA allows you to fund your retirement by investing in real estate, fine art, and other alternative investments. The Alto Crypto IRA, on the other hand, integrates directly with Coinbase, allowing you to invest your savings in over 200 different cryptocurrencies without the need for a separate crypto IRA Coinbase account.

Alto Crypto IRA + Coinbase

By opening an AltoCrypto IRA account, you can use Coinbase, which is one of the largest and most familiar crypto investment platforms. to invest in crypto while benefitting from the tax advantages of a crypto Roth IRA. If you’re a Coinbase user looking for a crypto IRA Coinbase, the Alto Crypto IRA is the IRA for you.

Coin Offerings

As one of the top crypto IRAs, the AltoCrypto IRA gives you access to over 200 coins. This is far more than any other crypto IRA. Alto Crypto is built to integrate directly with Coinbase. Therefore, every coin offered on the Coinbase exchange can be invested in by Alto Crypto users. As Coinbase, and thus Alto Crypto, continues to expand its coin offerings, you can expect even more crypto tokens to become available for tax-deferred or tax-free IRA investments.

Minimum Investment

In addition to offering the most coins, the Alto Crypto IRA also offers the lowest minimum investment of all crypto IRAs. The minimum investment required to open and fund an Alto Crypto IRA is only $10. In comparison, the BTC IRA requires a $3,000 minimum investment, making Alto the best crypto IRA for cash-strapped crypto enthusiasts looking to kickstart their retirement savings.

Fees

Rather than charging custody fees or monthly account fees, Alto Crypto charges a simple fee of one percent for each crypto trade. Due to its integration with Coinbase, the Coinbase fee is included in this fee amount.

The only other fees you’ll incur as an Alto Crypto IRA owner is a one-time $50 when/if you decide to close your account and a $25 fee whenever you withdraw funds via bank wire. Considering the tax advantages, this fee structure is a pretty sweet deal.

Safety and Security

Alto Crypto IRA cash funds are held in Coinbase-pooled bank accounts insured by the FDIC for up to $250,000. As far as digital assets go, those are held by Coinbase in both hot and cold wallets. While these security measures alone should be sufficient, Coinbase has multi-million-dollar insurance policies for both cyber-crime and commercial crime, adding an extra layer of protection.

That said, the wallets used are purely custodial. Since Coinbase is one of the world’s largest custodial exchanges, it only uses custodial wallets and doesn’t allow you to secure your funds using your own private keys.

Product Pros

Product Cons

Alto Crypto IRA vs iTrustCapital

iTrustCapital barely nudges out Alto Crypto IRA when it comes to the best crypto IRA. Both IRAs have no monthly fees, and a flat 1% investment fee.

Alto IRA has more coin options and a direct integration with coinbase.

However, we gave iTrustCapital IRA the nod because the company has been around longer, done more transaction volume, has more accounts, and offers more staking options.

Bitcoin IRA

As the original crypto IRA, Bitcoin IRA has a solid track record and offers over 60 different crypto assets to trade. It’s also different than other crypto IRAs in several ways.

First of all, and most importantly, it offers 100 percent offline cold storage. There are also no transaction fees, and users are able to earn up to six percent interest on crypto deposits.

Like others crypto IRAs, you can roll over an existing IRA, 401k, or other retirement plans to effortlessly transition from traditional assets to crypto for greater potential growth (and risk).

Coin Offerings

Contrary to its name, the BitcoinIRA currently supports over 60 cryptocurrencies. In addition to investing in cryptocurrencies, users can also invest in gold and receive ownership rights of physical gold bars kept in highly secure bullion vault facilities operated by the security company Brink’s.

Minimum Investment

There is no maximum limit on how much you can invest, but a standard account requires a minimum initial investment of $3,000. While this is steep compared to other crypto IRAs out there, you can opt for the Bitcoin Saver IRA instead and begin investing for your future by contributing just $100 per month.

Fees

On the downside, the fees can be hefty. In addition to a 5.99% setup fee when making an initial deposit, there’s also a 2% transaction fee per trade and a 0.08 percent monthly account fee.

These fees are considerably higher than the fees of competitors. However, the stability and interest-earning aspects of Bitcoin IRA retirement accounts can still make them an attractive option for some.

Bitcoin IRA Yield

If you have $10,000 in any one coin, you may be eligible for up to 6% yield on that particular coin. Be sure to check the terms on your specific coin before making your decision based on that yield.

Safety and Security

With Type 1 and Type II security certifications, SOC 1 + SOC 2, offline cold storage, multi-signature digital wallets, and $700 million in custody insurance, the Bitcoin IRA platform is extremely safe and secure.

Product Pros

Product Cons

Favorite Crypto IRA

Our rankings for the best Crypto IRA go:

Our Pick

iTrustCapital

Best for Staking

- Earn yield by staking major cryptos in IRA

- Over $6 Billion in volume and 175k accounts

- 1% flat trading fee

Alto Crypto IRA

Best Coin Selection

- Access to every coin on Coinbase (200+)

- Lowest minimum investment ($10)

- 1% flat trading fee

Bitcoin IRA

Highest fees

- The Oldest Crypto IRA

- Higher fees & $10k minimum investment

- 100% Cold Storage (rather than coinbase custody)

Which Crypto IRA is Right for You?

Investing in any crypto can be risky, but due to the continued growth and adoption of crypto, the downside risks can be negated by long-term HODL strategies like investing in Crypto IRAs. Crypto IRAs can also save you thousands of dollars in taxes when it’s time to clock out, cash out, and enjoy your retirement.

However, as you can see, not all crypto IRAs are created equal. The fees, coin offerings, minimum investment requirements, and a variety of other factors differ from one crypto IRA to the next.

Deciding on the right one to invest in requires weighing several pros and cons and taking a long, hard look at your finances and financial goals. While no one can predict the price of BTC, ETH, or another crypto 20 years from now, selecting the right crypto IRA can pay huge dividends down the road.

Further Reading: